Microsoft Excel for the Corporate Financial Analyst

Microsoft Excel for the Corporate Financial Analyst, available at $19.99, has an average rating of 4.5, with 51 lectures, based on 3 reviews, and has 22 subscribers.

You will learn about Learn the core formulas and key practices that take you from Excel beginner or intermediate to POWER USER Become the most skilled analyst on your team by mastering ability to dynamically model business scenarios in Excel Learn formatting best practices to build credibility and create executive-ready analyses Perform calculations frequently used in corporate financial analyst roles This course is ideal for individuals who are Aspiring corporate finance professional looking to develop their Excel skills to land a financial analyst job or Entry level financial analyst looking to improve their Excel skills to stand out from their peers and get promoted to senior financial analyst It is particularly useful for Aspiring corporate finance professional looking to develop their Excel skills to land a financial analyst job or Entry level financial analyst looking to improve their Excel skills to stand out from their peers and get promoted to senior financial analyst.

Enroll now: Microsoft Excel for the Corporate Financial Analyst

Summary

Title: Microsoft Excel for the Corporate Financial Analyst

Price: $19.99

Average Rating: 4.5

Number of Lectures: 51

Number of Published Lectures: 51

Number of Curriculum Items: 51

Number of Published Curriculum Objects: 51

Original Price: $39.99

Quality Status: approved

Status: Live

What You Will Learn

- Learn the core formulas and key practices that take you from Excel beginner or intermediate to POWER USER

- Become the most skilled analyst on your team by mastering ability to dynamically model business scenarios in Excel

- Learn formatting best practices to build credibility and create executive-ready analyses

- Perform calculations frequently used in corporate financial analyst roles

Who Should Attend

- Aspiring corporate finance professional looking to develop their Excel skills to land a financial analyst job

- Entry level financial analyst looking to improve their Excel skills to stand out from their peers and get promoted to senior financial analyst

Target Audiences

- Aspiring corporate finance professional looking to develop their Excel skills to land a financial analyst job

- Entry level financial analyst looking to improve their Excel skills to stand out from their peers and get promoted to senior financial analyst

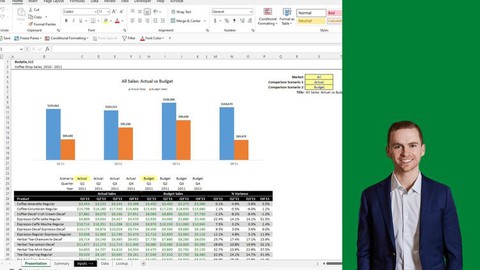

Learn the essential formulas, best practices, and modeling techniques that will take you from Microsoft Excel novice to power-user. We’ll break everything down step-by-step, then put all the pieces together at the end to build a dynamic model to analyze sales performance under various financial scenarios. The skills learned in this course will translate directly to the workplace; this course is practical, and students can immediately apply their knowledge on the job.

This course is best suited for either college students looking to bolster their Excel skills and land their first financial analyst job / internship, or early career corporate financial analysts who want to take their Excel skills to the next level to stand out among their peers and get promoted.

What we’ll cover:

· Improving Productivity:Learn the importance of using keyboard shortcuts to boost productivity.

· Basic Excel Operations:Learn how to navigate through Excel efficiently, lock cell references, create pivot tables, and more.

· Formatting Best Practices: Proper formatting is key to building credible analyses that leadership will trust; learn how to make your Excel tables look polished and presentable.

· The Core Excel Formulas: Excel can feel overwhelming due to the sheer number of formulas, but by mastering just this portion of the formulas you can become a power-user.

· Text Functions: Learn to clean messy data by combining values in multiple columns, extracting single words from larger strings of text, and more.

· Essential Calculations for Corporate Financial Analysts:Understand how to calculate weighted averages, year-over-year growth rates, and compound annual growth rates, three key calculations for any financial analyst to be comfortable with.

· Building a Dynamic Model: Combine the formulas and skills above to take a simple CSV file with sales data and turn it into a dynamic model that allows users to perform scenario analysis, a skill that will make you stand out among your peers.

Course Curriculum

Chapter 1: Introduction

Lecture 1: Introduction

Chapter 2: Improving Productivity

Lecture 1: Choosing a Good Keyboard

Lecture 2: Keyboard Shortcuts

Lecture 3: Quick Access Toolbar

Chapter 3: Basic Excel Operations

Lecture 1: Navigating with the Arrow Keys

Lecture 2: Cell References

Lecture 3: Filtering Data

Lecture 4: Grouping Rows and Columns

Lecture 5: Paste Special

Lecture 6: Pivot Tables

Lecture 7: Practice Exercise

Chapter 4: Formatting Best Practices

Lecture 1: Why does this matter?

Lecture 2: Where to Begin?

Lecture 3: Number Formats

Lecture 4: Alignment

Lecture 5: Format Painter

Lecture 6: Font Color, Fill Color, Borders, & Conditional Formatting

Lecture 7: Footnotes

Lecture 8: Color Coding

Lecture 9: Practice Exercise

Chapter 5: The Core Formulas

Lecture 1: Section Intro

Lecture 2: The "Lookup" Concept

Lecture 3: XLOOKUP

Lecture 4: VLOOKUP

Lecture 5: INDEX(MATCH())

Lecture 6: INDEX(MATCH(),MATCH())

Lecture 7: The "If(s)" Concept

Lecture 8: IF Statements

Lecture 9: The AND Operator

Lecture 10: The OR Operator

Lecture 11: Nested IF Statements

Lecture 12: IFERROR

Lecture 13: SUMIFS

Lecture 14: COUNTIFS

Lecture 15: Practice Exercise

Chapter 6: Text Functions

Lecture 1: Section Intro

Lecture 2: CONCATENATE

Lecture 3: LEFT and RIGHT

Lecture 4: MID

Lecture 5: FIND and LEN

Lecture 6: TRIM

Lecture 7: Combing Text Functions

Lecture 8: Practice Exercise

Chapter 7: Essential Calculations for Corporate Financial Analysts

Lecture 1: Weighted Averages

Lecture 2: Growth Rate

Lecture 3: CAGR (Compound Annual Growth Rate)

Lecture 4: Practice Exercise

Chapter 8: Dynamic Excel Model Overview

Lecture 1: Model Structure

Lecture 2: Prepping Source Data

Lecture 3: Summary Data Tab

Lecture 4: Presentation Tab

Instructors

-

James K

Finance & Analytics Professional

Rating Distribution

- 1 stars: 0 votes

- 2 stars: 0 votes

- 3 stars: 0 votes

- 4 stars: 2 votes

- 5 stars: 1 votes

Frequently Asked Questions

How long do I have access to the course materials?

You can view and review the lecture materials indefinitely, like an on-demand channel.

Can I take my courses with me wherever I go?

Definitely! If you have an internet connection, courses on Udemy are available on any device at any time. If you don’t have an internet connection, some instructors also let their students download course lectures. That’s up to the instructor though, so make sure you get on their good side!

You may also like

- Best Cybersecurity Fundamentals Courses to Learn in March 2025

- Best Smart Home Technology Courses to Learn in March 2025

- Best Holistic Health Courses to Learn in March 2025

- Best Nutrition And Diet Planning Courses to Learn in March 2025

- Best Yoga Instruction Courses to Learn in March 2025

- Best Stress Management Courses to Learn in March 2025

- Best Mindfulness Meditation Courses to Learn in March 2025

- Best Life Coaching Courses to Learn in March 2025

- Best Career Development Courses to Learn in March 2025

- Best Relationship Building Courses to Learn in March 2025

- Best Parenting Skills Courses to Learn in March 2025

- Best Home Improvement Courses to Learn in March 2025

- Best Gardening Courses to Learn in March 2025

- Best Sewing And Knitting Courses to Learn in March 2025

- Best Interior Design Courses to Learn in March 2025

- Best Writing Courses Courses to Learn in March 2025

- Best Storytelling Courses to Learn in March 2025

- Best Creativity Workshops Courses to Learn in March 2025

- Best Resilience Training Courses to Learn in March 2025

- Best Emotional Intelligence Courses to Learn in March 2025