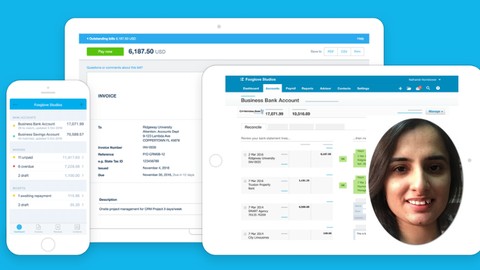

The Complete Xero Accounting Course : Master Xero in 4 Hours

The Complete Xero Accounting Course : Master Xero in 4 Hours, available at $19.99, has an average rating of 3.6, with 64 lectures, 1 quizzes, based on 149 reviews, and has 562 subscribers.

You will learn about Can Setup Xero from Scratch Can enter sales, purchase & expense claims accurately in xero Can do bank reconciliation and cash coding easily Can run payroll in xero Can Create inventory – tracked and untracked in xero Can Create Budget in Xero Can generate and use Xero Reports as per business need Can import past data in Xero Can work confidently in xero at job or for clients / own business Can avoid errors in Xero Accounting Can Save time while using xero This course is ideal for individuals who are Accounting Students or Accountants or Bookkeeper or Business Owners Using Xero or Planning to use cloud based accounting software It is particularly useful for Accounting Students or Accountants or Bookkeeper or Business Owners Using Xero or Planning to use cloud based accounting software.

Enroll now: The Complete Xero Accounting Course : Master Xero in 4 Hours

Summary

Title: The Complete Xero Accounting Course : Master Xero in 4 Hours

Price: $19.99

Average Rating: 3.6

Number of Lectures: 64

Number of Quizzes: 1

Number of Published Lectures: 64

Number of Published Quizzes: 1

Number of Curriculum Items: 65

Number of Published Curriculum Objects: 65

Number of Practice Tests: 1

Number of Published Practice Tests: 1

Original Price: $19.99

Quality Status: approved

Status: Live

What You Will Learn

- Can Setup Xero from Scratch

- Can enter sales, purchase & expense claims accurately in xero

- Can do bank reconciliation and cash coding easily

- Can run payroll in xero

- Can Create inventory – tracked and untracked in xero

- Can Create Budget in Xero

- Can generate and use Xero Reports as per business need

- Can import past data in Xero

- Can work confidently in xero at job or for clients / own business

- Can avoid errors in Xero Accounting

- Can Save time while using xero

Who Should Attend

- Accounting Students

- Accountants

- Bookkeeper

- Business Owners Using Xero or Planning to use cloud based accounting software

Target Audiences

- Accounting Students

- Accountants

- Bookkeeper

- Business Owners Using Xero or Planning to use cloud based accounting software

Hi,

Warm welcome to the Xero Course Page.

How our course helped students shaping their career:

“The course is easy and simple to understand.”

–

“It is an excellent course. Very well presented and it covers Xero in great detail. I have now managed to secure a position running the accounts of a business that uses Xero. Thanks so much, it was a great learning experience!”

–

“Cool ! The best Training for Xero.Guys,just enroll it, and start learning.”

This course is for beginners who want to learn Xero Accounting / Xero Bookkeeping with simplified method.

No need to enroll in multiple courses. One course is enough.

The course is in English language with Caption. We have happy students from UK, USA, AUS, NZ, Malaysia.

In this course, you will able to learn following:

-

Xero Setup

-

Xero Purchase / Sales / Expense Claim

-

Bank Reconciliation in Xero

-

Xero Payroll

-

Inventory in Xero

-

Xero Reporting

-

Xero Budgeting

-

Past data import in xero

-

Chart of Accounts

-

Conversion Balances

The course has +240 minutes ( 4 Hours ) of content having 61 lectures.

-

First section is introduction section.

-

Second part is Xero Setup from Beginning including setup of chart of accounts and conversion balance.

-

In third section, you will learn Fixed Asset setup, import of fixed assets and how to run depreciation.

-

Fourth and Fifth Part explains Sales and purchase transaction entry and import of Sales / Purchase in bulk.

-

Sixth section explains how to do bank reconciliation in xero and do cash coding.

-

Seventh section covers tracked and untracked inventory.

-

At eighth section, you will learn Payroll run and adding employee details.

-

At ninth section, you will learn how to add expense claim in xero manually and with mobile app – xero expense.

-

At tenth section, you will learn how to create budgets in xero and compare with actual numbers.

-

At last section, you will learn about reporting.

Note: We recommend get xero trial and do your own practice after learning each section. This will help you a lot.

You should take this course because it is simple and still effective and covering basics in very short duration. After completion of course, Your xero skill will be strong and you will be able to do basic and advanced xero accounting for business or at job or for client. You can view preview lectures FREE before purchasing !

For puchasing, Just click the Add to Cart button. You have nothing to lose. In fact, you have got a lot to gain. There is 30 days refund policy so buy the course risk free.

Thanks,

Tarannum

Course Curriculum

Chapter 1: Introduction

Lecture 1: Introduction

Lecture 2: Get Free 30 Days Trial of Xero

Lecture 3: Xero Dashboard Introduction

Chapter 2: Xero Setup

Lecture 1: Settings : Introduction, organisation, currency setting, user setting

Lecture 2: Connected apps, Subscription, invoice settings, payment Settings

Lecture 3: Settings : Check Style & Email settings

Lecture 4: Settings : Xero to Xero, Financial Settings, Custom Contact Links

Lecture 5: Settings : Tax Rates

Lecture 6: Settings : Tracking Categories

Lecture 7: Xero Settings : Practice Questions

Lecture 8: Setting : Chart of Accounts Editing

Lecture 9: Settings : Import of Chart of Accounts

Lecture 10: Chart of Accounts : Practice Test

Lecture 11: Conversion balance 1

Lecture 12: Conversion Balance 2

Lecture 13: Practice Exercise : Conversion Balance

Lecture 14: Contacts : Adding , import and merging Contacts

Chapter 3: Fixed asset

Lecture 1: How to add fixed asset type and add fixed asset in xero

Lecture 2: Editing, Deleting and Disposal of Fixed Assets

Lecture 3: Fixed Asset : Run depreciation and Reconcile with reconcile reports

Lecture 4: How to import fixed assets in bulk

Chapter 4: Sales

Lecture 1: Sales : Introduction and Section Overview

Lecture 2: Creation of sales invoice in New layout

Lecture 3: Creation of sales invoice without tax in Old View

Lecture 4: Creation of Tax invoice

Lecture 5: Repeating Invoice in Xero

Lecture 6: Creation of Sales Credit Note

Lecture 7: Import of sales Invoices in Bulk

Lecture 8: Sales Quote in xero

Lecture 9: Practical Exercise : Sales

Chapter 5: Purchase

Lecture 1: Purchase : Section Overview and Domestic bill entry

Lecture 2: How to create purchase bill in Multi Currency

Lecture 3: How to create purchase bill from Email

Lecture 4: Purchase Order

Chapter 6: Banking

Lecture 1: Bank Account : Creation, Bank Feed setting & Import of Statement

Lecture 2: Bank Reconciliation : Domestic transactions and Introduction

Lecture 3: Bank Reconciliation: Multi currency Transaction, Cash coding

Lecture 4: Bank Reconciliation Report and Statement Exception Report

Chapter 7: Inventory : Tracked and Untracked

Lecture 1: How to add service as item using untracked inventory and create sale

Lecture 2: Tracked and untracked inventory and how to add tracked inventory item in xero

Lecture 3: How to import inventory and import opening balance of inventory items

Lecture 4: Tracked Inventory : Entering sales and purchase in xero

Lecture 5: Inventory Report

Lecture 6: Creation of inventory without using Tracking Inventory Feature

Chapter 8: Payroll

Lecture 1: How to setup payroll

Lecture 2: How to run payroll in xero

Lecture 3: Payroll Reporting

Chapter 9: Budgeting in Xero

Lecture 1: How to create Budget in Xero

Lecture 2: Budget Report Explanation

Chapter 10: Expense Claim

Lecture 1: Understand basic and How to enter expense claim in classic view

Lecture 2: New expense claim features Explanation and learn to setup expense claim

Lecture 3: Loading expense claim using xero app & using new expense claim Dashboard Xero

Chapter 11: Reports

Lecture 1: Reporting Section – Short Introduction

Lecture 2: Balance Sheet Reports

Lecture 3: Setting up custom layout in reports – learn with balance sheet example

Lecture 4: Income Statement Report

Lecture 5: Cash summary Report

Lecture 6: Aged Receivable Report

Lecture 7: Aged Payable Report

Lecture 8: Trial Balance Report

Lecture 9: General Ledger Report

Lecture 10: Account transactions and Contact transactions report

Lecture 11: Tax Reports

Chapter 12: Wrap Up

Lecture 1: Good Bye & See You Soon

Instructors

-

CA Tarannum Khatri

Chartered Accountant

Rating Distribution

- 1 stars: 5 votes

- 2 stars: 11 votes

- 3 stars: 30 votes

- 4 stars: 57 votes

- 5 stars: 46 votes

Frequently Asked Questions

How long do I have access to the course materials?

You can view and review the lecture materials indefinitely, like an on-demand channel.

Can I take my courses with me wherever I go?

Definitely! If you have an internet connection, courses on Udemy are available on any device at any time. If you don’t have an internet connection, some instructors also let their students download course lectures. That’s up to the instructor though, so make sure you get on their good side!

You may also like

- Top 10 Video Editing Courses to Learn in November 2024

- Top 10 Music Production Courses to Learn in November 2024

- Top 10 Animation Courses to Learn in November 2024

- Top 10 Digital Illustration Courses to Learn in November 2024

- Top 10 Renewable Energy Courses to Learn in November 2024

- Top 10 Sustainable Living Courses to Learn in November 2024

- Top 10 Ethical AI Courses to Learn in November 2024

- Top 10 Cybersecurity Fundamentals Courses to Learn in November 2024

- Top 10 Smart Home Technology Courses to Learn in November 2024

- Top 10 Holistic Health Courses to Learn in November 2024

- Top 10 Nutrition And Diet Planning Courses to Learn in November 2024

- Top 10 Yoga Instruction Courses to Learn in November 2024

- Top 10 Stress Management Courses to Learn in November 2024

- Top 10 Mindfulness Meditation Courses to Learn in November 2024

- Top 10 Life Coaching Courses to Learn in November 2024

- Top 10 Career Development Courses to Learn in November 2024

- Top 10 Relationship Building Courses to Learn in November 2024

- Top 10 Parenting Skills Courses to Learn in November 2024

- Top 10 Home Improvement Courses to Learn in November 2024

- Top 10 Gardening Courses to Learn in November 2024